Are you aware of the diverse ways to fund infrastructure development projects? The answer lies in understanding the various infrastructure financing models available.

Infrastructure development is crucial for a country’s growth, and exploring different infrastructure investment strategies can help unlock new opportunities.

Different financing models, including government funding, public-private partnerships, and innovative solutions, play a vital role in bringing development initiatives to life.

Key Takeaways

- Understanding various infrastructure financing models is crucial for development projects.

- Government funding is a traditional method for infrastructure financing.

- Public-private partnerships offer an alternative financing solution.

- Innovative financing solutions are emerging to support infrastructure development.

- Effective infrastructure investment strategies can drive economic growth.

Understanding Infrastructure Financing

As global infrastructure needs continue to grow, understanding the mechanisms and models of infrastructure financing becomes increasingly important. Infrastructure financing is not just about allocating funds; it’s about creating sustainable, efficient, and effective financial structures that support development projects.

What is Infrastructure Financing?

Infrastructure financing refers to the financial strategies and instruments used to fund infrastructure projects. This can include a wide range of funding options such as government appropriations, public-private partnerships (PPPs), municipal bonds, and private investment. The choice of financing model depends on the project’s nature, size, and risk profile.

Key components of infrastructure financing include:

- Project identification and planning

- Financial structuring and risk assessment

- Selection of funding sources

- Oversight and management of project execution

Importance of Infrastructure Financing

Infrastructure financing is crucial for economic development, as it enables the creation and maintenance of essential public works such as roads, bridges, airports, and public transportation systems. Effective infrastructure financing can stimulate economic growth, improve quality of life, and enhance the competitiveness of regions.

“Infrastructure is the backbone of economic growth, and financing it effectively is key to unlocking a region’s full potential.”

The importance of infrastructure financing can be seen in several areas:

| Economic Benefits | Social Benefits | Environmental Benefits |

|---|---|---|

| Stimulates economic growth | Improves quality of life | Promotes sustainable development |

| Enhances regional competitiveness | Supports public health and safety | Reduces environmental impact |

Key Stakeholders in Infrastructure Financing

Infrastructure financing involves various stakeholders, including government entities, private investors, and financial institutions. Each stakeholder plays a critical role in the financing process.

Government agencies are responsible for setting policies, regulations, and standards for infrastructure development. They also provide funding through appropriations and grants.

Private investors and financial institutions provide capital for infrastructure projects through various instruments such as equity, debt, and bonds. They are attracted to infrastructure investments due to their potential for stable, long-term returns.

Understanding the roles and responsibilities of these stakeholders is essential for developing effective infrastructure financing strategies.

Traditional Financing Models for Infrastructure

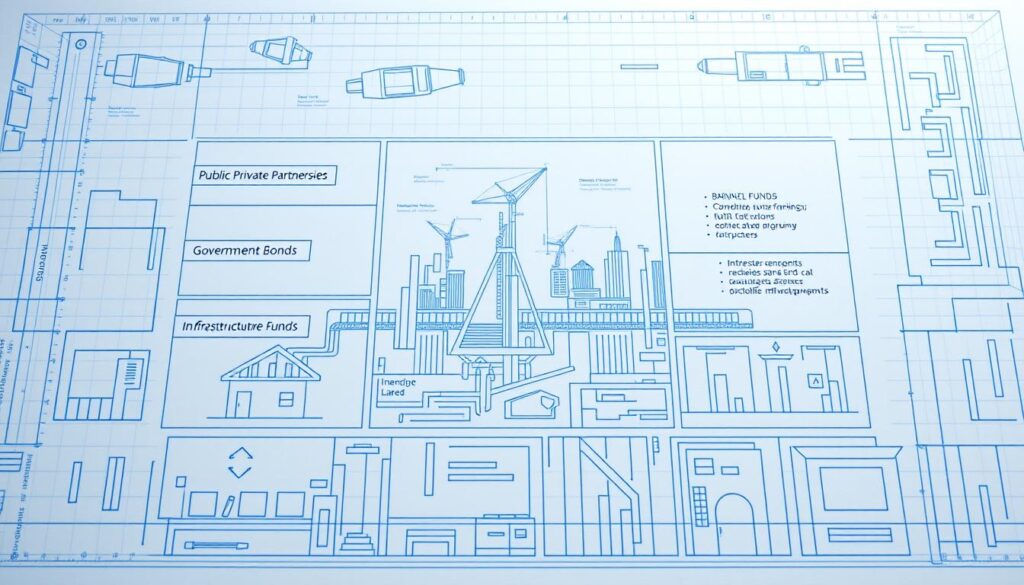

Traditional financing models for infrastructure development are diverse, including government funding, public-private partnerships, and bonds. These models have been instrumental in facilitating the development of critical infrastructure projects.

Government Funding and Budget Allocations

Government funding is a primary source of infrastructure financing. It involves allocating funds from the government budget to support infrastructure projects. This model is particularly useful for projects that are considered public goods or have significant social benefits but may not be commercially viable.

Advantages: Government funding can provide the necessary capital for large-scale projects without the immediate burden of repayment. It also allows for the development of infrastructure in areas that are not attractive to private investors.

Disadvantages: The reliance on government funds can be constrained by budget limitations and competing priorities. Moreover, bureaucratic processes can delay project implementation.

- Direct government grants

- Appropriations from the national or state budget

- Special infrastructure funds

Public-Private Partnerships (PPPs)

PPPs involve collaboration between the government and private sector entities to finance, develop, and operate infrastructure projects. This model leverages the strengths of both sectors to deliver projects efficiently.

Successful PPPs can bring significant benefits, including improved project management, innovation, and cost savings. For instance, a PPP can enable the government to transfer certain risks to the private sector, such as construction and operational risks.

“PPPs can be an effective way to deliver infrastructure projects by combining the best of public and private sector capabilities.” – Mastering Infrastructure Finance

Bonds and Debt Instruments

Bonds and other debt instruments are commonly used to finance infrastructure projects. These financial tools allow governments and private companies to raise capital from a wide range of investors.

Types of Bonds:

- Municipal bonds issued by local governments

- Corporate bonds issued by private companies

- Infrastructure bonds specifically designed for infrastructure projects

The use of bonds and debt instruments for infrastructure financing offers flexibility and can attract a diverse investor base. However, it also involves the obligation to repay the debt with interest, which can be a significant burden.

Emerging Trends in Infrastructure Financing

The future of infrastructure financing is being shaped by several emerging trends. As the world grapples with the challenges of climate change, technological disruption, and economic uncertainty, the infrastructure financing landscape is evolving to meet new demands.

Green Financing and Sustainable Investments

Green financing and sustainable investments are becoming increasingly important in infrastructure development. Investors are looking for projects that not only provide financial returns but also contribute to environmental sustainability and social welfare. Green bonds are a popular instrument for financing renewable energy projects, energy-efficient buildings, and sustainable transportation systems.

The growth of green financing is driven by the need to mitigate climate change and achieve global sustainability goals. Governments and corporations are issuing green bonds to fund projects that reduce carbon emissions and promote sustainable development.

Digital Infrastructure Financing

Digital infrastructure financing is another emerging trend. The rapid expansion of digital technologies requires significant investment in digital infrastructure, including data centers, telecommunications networks, and cybersecurity systems. Digital infrastructure financing models are being developed to support the growth of the digital economy.

Investors are recognizing the potential of digital infrastructure to drive economic growth and improve quality of life. As a result, there is a growing interest in financing digital infrastructure projects that can provide stable returns and contribute to the development of smart cities and communities.

Impact of Technology on Financing Models

Technology is having a profound impact on infrastructure financing models. The use of blockchain, artificial intelligence, and other digital technologies is improving the efficiency and transparency of infrastructure financing. These technologies are enabling new financing models, such as crowdfunding and peer-to-peer lending, to emerge.

The impact of technology on financing models is also being felt in the area of risk management. Advanced data analytics and machine learning algorithms are being used to better assess and manage risks in infrastructure projects, making it easier to attract investors and secure funding.

Challenges in Infrastructure Financing

Despite its importance, infrastructure financing faces numerous obstacles that need to be addressed. The success of infrastructure projects depends on overcoming these challenges to ensure their viability and sustainability.

Risk Management in Infrastructure Projects

Risk management is a critical aspect of infrastructure financing. Projects often involve large investments and long gestation periods, making them susceptible to various risks such as economic fluctuations, regulatory changes, and environmental factors. Effective risk management strategies are essential to mitigate these risks and ensure project success.

One of the key strategies is to conduct thorough feasibility studies and assessments to identify potential risks early on. This allows stakeholders to develop mitigation plans and allocate resources effectively. Additionally, involving multiple stakeholders, including investors, governments, and contractors, can help distribute risk and make projects more resilient.

Regulatory and Compliance Issues

Regulatory and compliance issues pose significant challenges in infrastructure financing. Projects must comply with a myriad of regulations and standards, which can vary significantly across jurisdictions. Navigating this complex regulatory landscape requires careful planning and coordination among stakeholders.

To address these challenges, it is crucial to stay informed about the latest regulatory developments and engage with relevant authorities. According to a report by PwC on global infrastructure trends, understanding regulatory frameworks is key to successful project execution.

Financial Sustainability Concerns

Financial sustainability is a major concern in infrastructure financing. Ensuring that projects are financially viable over their lifecycle is crucial for their success. This involves careful financial planning, including the selection of appropriate funding options for infrastructure projects and managing cash flows effectively.

Moreover, adopting sustainable financing models, such as green financing, can enhance the financial sustainability of infrastructure projects. These models not only provide access to new funding sources but also contribute to environmental sustainability, aligning with global infrastructure finance trends.

Innovative Financing Solutions

Innovative financing solutions are transforming the infrastructure landscape, offering new avenues for investment and development. These novel approaches are crucial in addressing the funding gap for infrastructure projects, enabling the implementation of sustainable and efficient solutions.

Crowdfunding for Infrastructure Projects

Crowdfunding has emerged as a viable option for financing infrastructure projects, allowing multiple stakeholders to contribute small amounts of money towards a large project. This approach not only democratizes investment but also fosters community engagement and support for infrastructure development.

Platforms dedicated to infrastructure crowdfunding are on the rise, providing a space for project initiators to showcase their proposals and attract funding from a wide array of investors. For instance, exploring innovative funding models can provide insights into how crowdfunding is being utilized.

Social Impact Bonds

Social Impact Bonds (SIBs) represent another innovative financing mechanism, where private investors provide upfront capital for public projects that deliver specific social outcomes. If the project achieves its predetermined objectives, the government repays the investors with a return, thereby aligning financial returns with social impact.

SIBs are particularly useful for projects that have a clear social benefit but may not be immediately attractive to traditional investors. They encourage a collaborative approach between government, private sector, and social organizations to achieve common goals.

Infrastructure as a Service (IaaS)

Infrastructure as a Service (IaaS) models are gaining traction, where infrastructure is provided as a service rather than being owned outright. This approach allows for flexible financing options, where users pay for the infrastructure they use, similar to a utility.

IaaS can be particularly beneficial for digital infrastructure, enabling businesses and governments to access cutting-edge infrastructure without the need for significant upfront capital expenditure.

| Innovative Financing Solution | Description | Benefits |

|---|---|---|

| Crowdfunding | Platforms that allow multiple stakeholders to invest small amounts in infrastructure projects. | Democratizes investment, fosters community engagement. |

| Social Impact Bonds | Private investors fund public projects with specific social outcomes. | Aligns financial returns with social impact, encourages collaboration. |

| Infrastructure as a Service (IaaS) | Infrastructure provided as a service, with users paying for what they use. | Flexible financing, reduces upfront capital expenditure. |

The Role of Government in Infrastructure Financing

The role of government in infrastructure financing is multifaceted, involving federal, state, and local initiatives. Government support is crucial for the development and implementation of infrastructure projects, which are vital for economic growth and public welfare.

Federal Assistance Programs

Federal assistance programs play a significant role in infrastructure financing by providing financial support for various projects. These programs can include grants, loans, and other forms of assistance that help fund infrastructure development.

For instance, the federal government has introduced innovative financing for public infrastructure projects, enhancing the scope and scale of development.

Key aspects of federal assistance programs include:

- Funding for transportation infrastructure

- Support for water and sewage systems

- Grants for public buildings and facilities

State and Local Government Initiatives

State and local governments also play a crucial role in infrastructure financing through their own initiatives and programs. These can include public-private partnerships (PPPs) that leverage private investment for public infrastructure projects.

“Public-private partnerships have emerged as a vital mechanism for delivering infrastructure projects, combining the efficiency of the private sector with the public interest.”

State and local initiatives can vary widely, from financing mechanisms for specific projects to broader policy initiatives that encourage infrastructure investment.

Infrastructure Financing Banks

Infrastructure financing banks are specialized institutions that provide financing for infrastructure projects. These banks can offer a range of financial products, including loans and bonds, tailored to the needs of infrastructure development.

The establishment of infrastructure financing banks represents a significant step towards creating dedicated funding mechanisms for infrastructure projects, helping to bridge the financing gap.

Benefits of infrastructure financing banks include:

- Access to specialized financing for infrastructure projects

- Enhanced financial structuring options for complex projects

- Increased investment in critical infrastructure

Importance of Private Investment

Private investment plays a crucial role in bridging the infrastructure financing gap. As governments face budget constraints, private capital is increasingly being sought to fund infrastructure projects.

Attracting Private Capital to Infrastructure

Attracting private capital to infrastructure requires a multifaceted approach. This includes developing infrastructure investment strategies that are appealing to private investors, such as offering stable returns and mitigating risks.

“The involvement of private investors is crucial for the success of infrastructure projects,” says an expert in project finance. “It not only brings in much-needed capital but also introduces a level of efficiency and innovation that can be lacking in traditional public sector approaches.”

“Private investment in infrastructure can drive economic growth and improve the quality of life for communities.”

Case Studies of Successful Private Investments

Several case studies highlight the success of private investment in infrastructure. For instance, a major highway project was successfully financed through a public-private partnership (PPP), where private investors provided the majority of the capital in exchange for toll revenues.

- Project finance for infrastructure development was used to fund a renewable energy project.

- A private company invested in a water treatment plant, improving water quality for a large population.

Risks and Rewards for Private Investors

Private investors in infrastructure projects face various risks, including regulatory changes, project delays, and financial risks. However, the rewards can be substantial, with stable long-term returns and the potential for significant economic impact.

| Risks | Rewards |

|---|---|

| Regulatory changes | Stable long-term returns |

| Project delays | Economic impact |

| Financial risks | Potential for high returns |

In conclusion, private investment is vital for infrastructure financing, offering a range of benefits for both investors and the public. By understanding the risks and rewards, stakeholders can work together to develop successful infrastructure projects.

Financing Models for Renewable Energy Projects

Financing renewable energy projects requires a multifaceted approach, incorporating various models and incentives. As the world transitions towards cleaner energy sources, the need for innovative and sustainable financing solutions becomes increasingly important.

Overview of Renewable Infrastructure Financing

Renewable infrastructure financing has gained significant traction in recent years, driven by the growing demand for clean energy and sustainable infrastructure financing practices. Various financing models are being explored to support the development of renewable energy projects, including solar, wind, and hydroelectric power.

The key to successful renewable energy financing lies in understanding the different financing options available and their implications. This includes:

- Project finance

- Corporate finance

- Green bonds

- Public-private partnerships

Federal Incentives for Clean Energy

Federal incentives play a crucial role in promoting clean energy development by providing financial support and reducing the risks associated with renewable energy projects. Some of the key incentives include:

- Tax credits

- Grants

- Loan guarantees

These incentives not only encourage investment in renewable energy but also help in driving down the cost of clean energy technologies, making them more competitive with fossil fuels.

Partnerships for Renewable Energy Development

Partnerships between public and private entities are vital for the successful development of renewable energy projects. These partnerships leverage the strengths of both sectors, facilitating the sharing of risks and rewards. Key aspects of these partnerships include:

- Collaboration on project development

- Risk sharing

- Innovative financing solutions

By working together, governments and private investors can accelerate the transition to a more sustainable energy mix, aligning with infrastructure finance trends that prioritize sustainability and environmental stewardship.

Global Perspectives on Infrastructure Financing

As the world grapples with infrastructure challenges, international financing models offer valuable lessons. Different countries have adopted unique approaches to infrastructure financing, reflecting their economic conditions, regulatory frameworks, and development priorities.

Lessons from International Financing Models

Countries such as Japan and South Korea have successfully utilized public-private partnerships (PPPs) to finance large-scale infrastructure projects. These models have enabled the efficient allocation of risk and resources, facilitating the delivery of complex infrastructure projects.

Key Takeaways from International Models:

- Flexibility in financing structures

- Innovative risk management strategies

- Strong regulatory frameworks

Comparative Analysis of Global Practices

A comparative analysis of global infrastructure financing practices reveals diverse approaches to funding infrastructure projects. For instance, European countries have embraced green financing instruments, while Asian nations have focused on PPPs.

| Region | Predominant Financing Model | Notable Examples |

|---|---|---|

| Europe | Green Financing | Green bonds issued by the European Investment Bank |

| Asia | Public-Private Partnerships (PPPs) | Tokyo’s Metropolitan Expressway, India’s Highway Projects |

| North America | Municipal Bonds | U.S. municipal bond market for infrastructure financing |

Trends in Global Infrastructure Investment

The landscape of global infrastructure investment is evolving, driven by technological advancements and shifting investor preferences. Trends such as digital infrastructure financing and sustainable investments are gaining traction.

Emerging trends in global infrastructure investment include:

- Increased focus on sustainability and environmental impact

- Growing importance of digital infrastructure

- Rise of innovative financing instruments

By understanding these global perspectives and trends, stakeholders can develop more effective infrastructure financing strategies, leveraging international best practices and innovative financing models.

The Future of Infrastructure Financing

Infrastructure financing is on the cusp of a revolution, driven by the need for sustainable development and innovative funding solutions. As the world grapples with the challenges of climate change, urbanization, and technological advancement, the way we finance infrastructure projects is undergoing a significant transformation.

Predictions and Forecasts

Experts predict that the future of infrastructure financing will be characterized by a growing emphasis on sustainability and green financing. According to a report by the Global Infrastructure Hub, the world needs to invest around $3.7 trillion annually in infrastructure until 2040 to meet the Sustainable Development Goals (SDGs).

The increasing demand for renewable energy and green infrastructure is expected to drive growth in sustainable infrastructure financing. Innovative funding solutions, such as green bonds and social impact bonds, are becoming increasingly popular as they offer a way to align financial returns with social and environmental outcomes.

The Role of Innovation and Technology

Innovation and technology are playing a crucial role in shaping the future of infrastructure financing. Digital infrastructure financing, for instance, is becoming increasingly important as the world becomes more interconnected.

The use of technologies like blockchain and artificial intelligence (AI) is expected to improve the efficiency and transparency of infrastructure financing. Blockchain technology can help to reduce transaction costs and improve the security of financial transactions, while AI can help to analyze large datasets and identify potential investment opportunities.

Sustainability Goals and Infrastructure Development

The United Nations’ SDGs provide a framework for sustainable infrastructure development. Infrastructure financing will play a critical role in achieving these goals, particularly in areas such as affordable and clean energy, sustainable cities, and climate action.

To achieve these goals, it is essential to develop innovative funding solutions that can mobilize private capital and other sources of financing. Public-private partnerships (PPPs) are expected to play a key role in delivering sustainable infrastructure projects.

| Sustainability Goal | Infrastructure Financing Requirement | Potential Funding Sources |

|---|---|---|

| Affordable and Clean Energy | $1.5 trillion annually | Green bonds, private equity |

| Sustainable Cities | $1 trillion annually | Public-private partnerships, municipal bonds |

| Climate Action | $500 billion annually | Climate-themed bonds, impact investing |

Conclusion: Building a Strong Infrastructure Financing Framework

Building a strong infrastructure financing framework is crucial for achieving sustainable development goals. A comprehensive framework enables the effective allocation of resources, fosters collaboration among stakeholders, and ensures the long-term sustainability of infrastructure projects.

Key Recommendations

To build a robust infrastructure financing framework, several key recommendations should be considered. First, diversifying funding sources is essential to reduce dependence on a single financing mechanism. This can include a mix of government funding, private investments, and public-private partnerships in infrastructure financing. Second, implementing effective risk management strategies is critical to mitigate potential risks associated with infrastructure projects.

Third, fostering collaboration among stakeholders, including government agencies, private investors, and local communities, is vital to ensure that infrastructure projects meet the needs of all parties involved.

Importance of Collaboration

Collaboration is a cornerstone of successful infrastructure financing. By working together, stakeholders can share knowledge, resources, and risks, ultimately leading to more sustainable and effective infrastructure projects. Public-private partnerships, for example, have been instrumental in delivering infrastructure projects that might not have been feasible through government funding alone.

Future Outlook for Infrastructure Financing

The future of infrastructure financing looks promising, with emerging trends and technologies offering new opportunities for growth and development. As the global economy continues to evolve, the demand for innovative and sustainable infrastructure financing solutions will only continue to grow. By adopting a coordinated approach to infrastructure financing and leveraging diverse funding mechanisms, we can build a stronger, more resilient infrastructure that supports economic development and improves the quality of life for communities around the world.

Resources and Further Reading

To deepen your understanding of infrastructure financing models and investment strategies, several resources are available. The GI Hub website offers a wealth of information, including a library of over 100 global project case studies that utilized various financing levers to make projects bankable. You can explore these resources to gain insights into successful infrastructure financing models.

Recommended Resources for Infrastructure Financing

The GI Hub’s Innovative Funding and Financing Framework provides a comprehensive guide to infrastructure financing. Additionally, the Financing National Infrastructure compendium and case studies offer valuable information on infrastructure investment strategies.

Online Courses and Workshops

Several online courses and workshops are available to help you stay up-to-date with the latest trends in infrastructure financing. These resources cover topics such as green financing, digital infrastructure financing, and innovative financing solutions.

Organizations Promoting Infrastructure Financing Solutions

Various organizations, including the G20 Infrastructure Working Group, promote infrastructure financing solutions. These organizations provide valuable resources, including research reports and case studies, to support infrastructure development.